Small Business Bookkeeping Survival Guide: 10 Things You Must Do Monthly

- Kimi Witherell

- Dec 14, 2025

- 2 min read

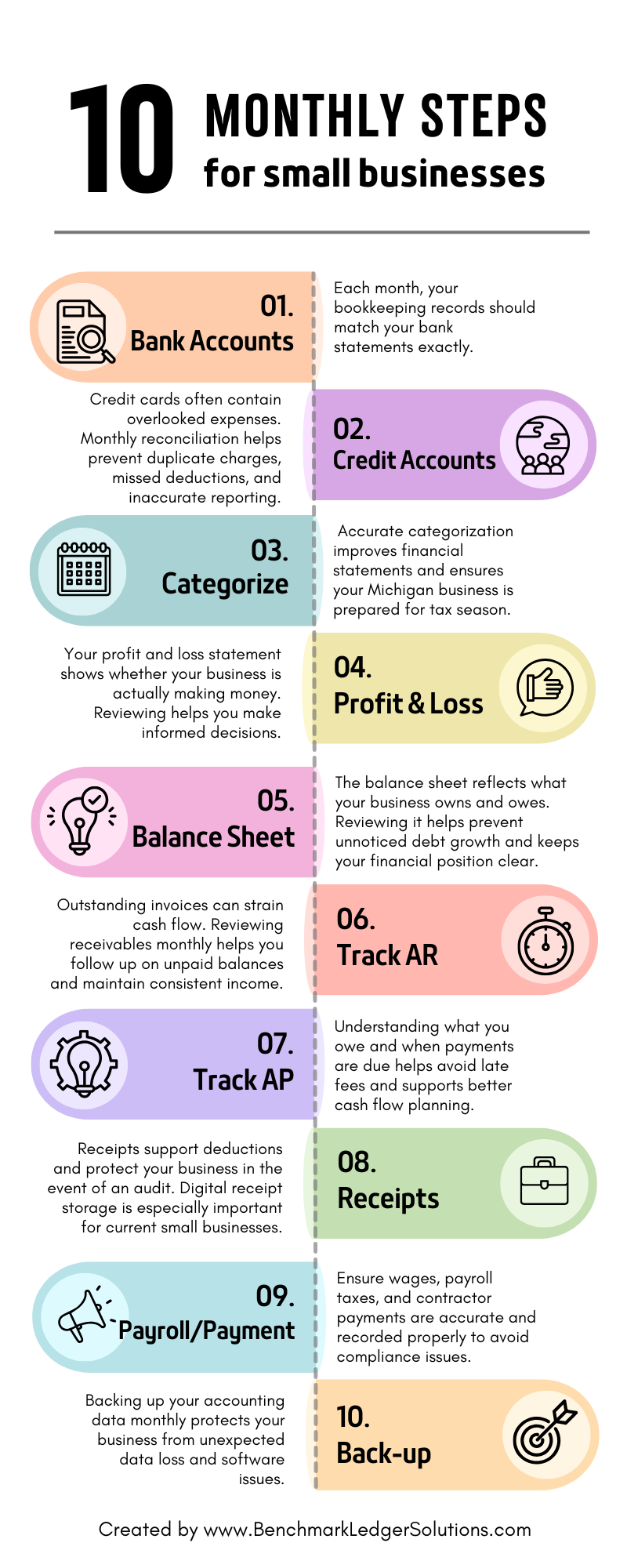

Consistent monthly bookkeeping is one of the most important habits a small business owner can build. Waiting until tax season or year-end often leads to missed deductions, cash flow surprises, and unnecessary stress. For Michigan small business owners, staying on top of their books monthly is essential to long-term stability and growth.

1. Reconcile Bank Accounts

Each month, your bookkeeping records should match your bank statements exactly. Bank reconciliations help catch errors early and ensure your financial data is accurate and reliable.

2. Reconcile Credit Card Accounts

Credit cards often contain overlooked expenses. Monthly reconciliation helps prevent duplicate charges, missed deductions, and inaccurate reporting.

3. Categorize All Transactions

Every transaction should be assigned to the proper account. Accurate categorization improves financial statements and ensures your Michigan business is prepared for tax season.

4. Review Your Profit and Loss Statement

Your profit and loss statement shows whether your business is actually making money. Reviewing it monthly helps you track trends, manage expenses, and make informed decisions.

5. Review the Balance Sheet

The balance sheet reflects what your business owns and owes. Reviewing it regularly helps prevent unnoticed debt growth and keeps your financial position clear.

6. Track Accounts Receivable

Outstanding invoices can strain cash flow. Reviewing receivables monthly helps you follow up on unpaid balances and maintain consistent income.

7. Track Accounts Payable

Understanding what you owe and when payments are due helps avoid late fees and supports better cash flow planning.

8. Save and Organize Receipts

Receipts support deductions and protect your business in the event of an audit. Digital receipt storage is especially important for small businesses operating across Michigan.

9. Review Payroll and Contractor Payments

Ensure wages, payroll taxes, and contractor payments are accurate and recorded properly to avoid compliance issues.

10. Back Up Financial Data

Backing up your accounting data monthly protects your business from unexpected data loss and software issues.

Why Monthly Bookkeeping Matters for Michigan Small Businesses

Monthly bookkeeping keeps your business tax-ready, improves cash flow visibility, and reduces stress at year's end. It also allows you to spot opportunities to save money and plan confidently for the future.

If managing monthly bookkeeping feels overwhelming, Benchmark Ledger Solutions can help. We provide professional virtual bookkeeping for small businesses and nonprofits throughout West Michigan and across the state of Michigan. Our services are designed to keep your books accurate, tax-ready, and easy to understand, so you can focus on running your business.

Whether you need ongoing monthly bookkeeping, QuickBooks support, or cleanup services, our Michigan-based team is here to support your growth with clarity and confidence.

Schedule a free consultation with Benchmark Ledger Solutions today and take control of your business finances.

Infographic

You can also access this and other resources by Benchmark Ledger Solutions here: https://drive.google.com/drive/folders/1c_bYY7lv3hw-E2VoiriCDeIP6UT678Wm?usp=drive_link

Comments